You are here

Sustainability requires a systems-based approach to design iteration. It is important to accurately account for the financial impacts of a design proposal. Also, understanding how systems thinking can be applied to cost can develop a better idea of how investment costs can be offset with Lifecycle Cost Analysis.

It is highly important not to omit the details of costs from the sustainable design conversation. Costs, translated at times as monetary economies, are the vehicle for supporting the execution of building projects. Everything has a financial value, and projects can only be realized when there is investment buy-in from stakeholders. Conducting building performance analysis is a valuable tool for filtering what design decisions can yield a more valuable economic return. Furthermore some building owners have very strict construction budgets, public elementary schools for example, that can cause the building design to remain within a firm financial budget that has been established in the pre-design phase of the project.

Costs Defined

Most often costs are associated with monetary expenses. However, there are a plethora of other qualities we can associate ”cost” with, such as environmental impact costs, resource use costs, human health costs, and time costs. When analyzing environmental impact costs the process is referred to as a Lifecycle Analysis, or Assessment (LCA).

While producing energy on site is great and reduces costs, the “math” to determine the Return on Investment (ROI) for such sustainable design features is not as straightforward as the costs required to purchase and install a product. Energy efficient technologies, and designs that reduce energy demands, are considered intelligent choices when considering investment and operation costs alone. But to truly get the full picture of a design project that decreases energy demands, a full LCCA should be considered.

Full Lifecycle Cost Analysis

- A building costs “A” to be built and can be sold or rented for “B”

- The difference between “B” and “A” is the ROI

- As a result, much of the ROI is based on real estate projections, which can change dramatically

In this scenario “A,” the investment cost, also dictates fifty percent of the equation, emphasizing the importance of the initial cost. For this reason the cost to erect a building has traditionally been the primary deciding factor in whether or not to build a particular design. For this reason, sustainable buildings may be more expensive to build, but it’s the ROI that is key.

Historically, only the initial and sale prices of a building were considered in LCCA. However, in order to consider the benefits of sustainable design, the capacity a design has to return energy must be considered in the calculation. Additionally, since the capacity of technologies to create energy is based on environmental conditions and equipment, the ROI is also much more predictable. The solar rays from the sun will not be altered by the real estate market, for example. All of this requires a new way of considering the financial cost of a building. Because there are capabilities to receive financial returns at a time period away from the initial construction of a building, “A,” LCCA must consider “C,” a variable that accounts for recurring return.

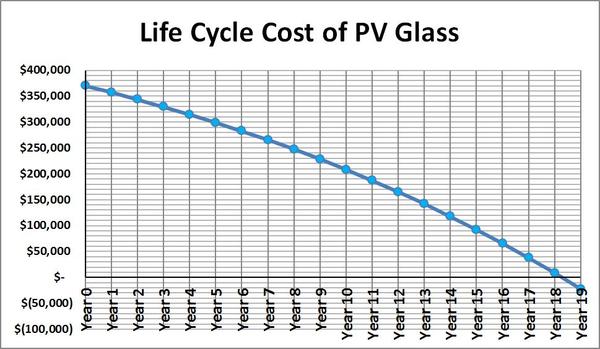

Design decisions must weigh initial cost against time period of pay back when proposing concepts to a building owner. Below is a LCCA that was conducted for a proposed photovoltaic glass panel roof in an ASHRAE student design competition.

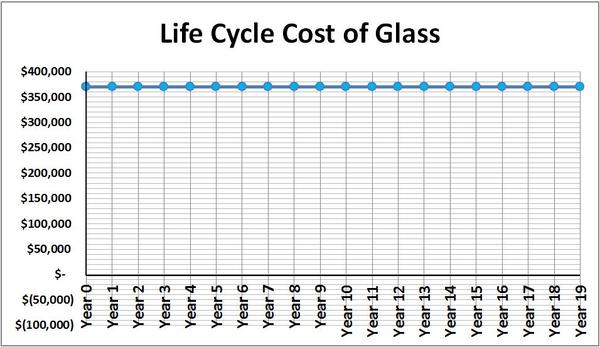

Here is another LCCA chart that uses traditional glazing that does not produce any energy.

|

| If maintenance was accounted for in this analysis, the cost would actually be a net gain each year. |

As can be observed, the PV glass pays for its self around year eighteen. In the year following the glass starts being completely profitable. Whether or not eighteen years is too long of an investment pay back is for the building owner to decide. But at least the designer related the proposed design to financial incentives and had an awareness of how economics fit into the sustainable goals of reducing energy consumption.

If the building owner was only presented with the initial cost around $350,000 they might not be interested in this PV glass concept. This could cause the owner to potentially opt for the traditional glazing that could have as much as a thirty five percent reduced investment cost, but have no real capability to pay for itself. Sustainable design is not only good for the planet, but it also has sound economic rational.

Leveraging Cost in BPA

Building performance analysis makes LCCA more accessible to the design process. Through the combination of BPA methods, and BIM technologies, data is readily available for analysis. This data at any point in time can be run through LCCA of comparing investment, operation, and return.

Links and References

- Detailed report explaining LCA and LCCA